A Bitter Truth: In Reality, Open-Loop Payments Are 35 Times More Expensive

Published:

Exhausted by the seemingly unfounded advantages of open-loop payments and the buzz surrounding it, I found myself compelled to do some number-crunching (I wonder if I’m the lone ranger in this pursuit).

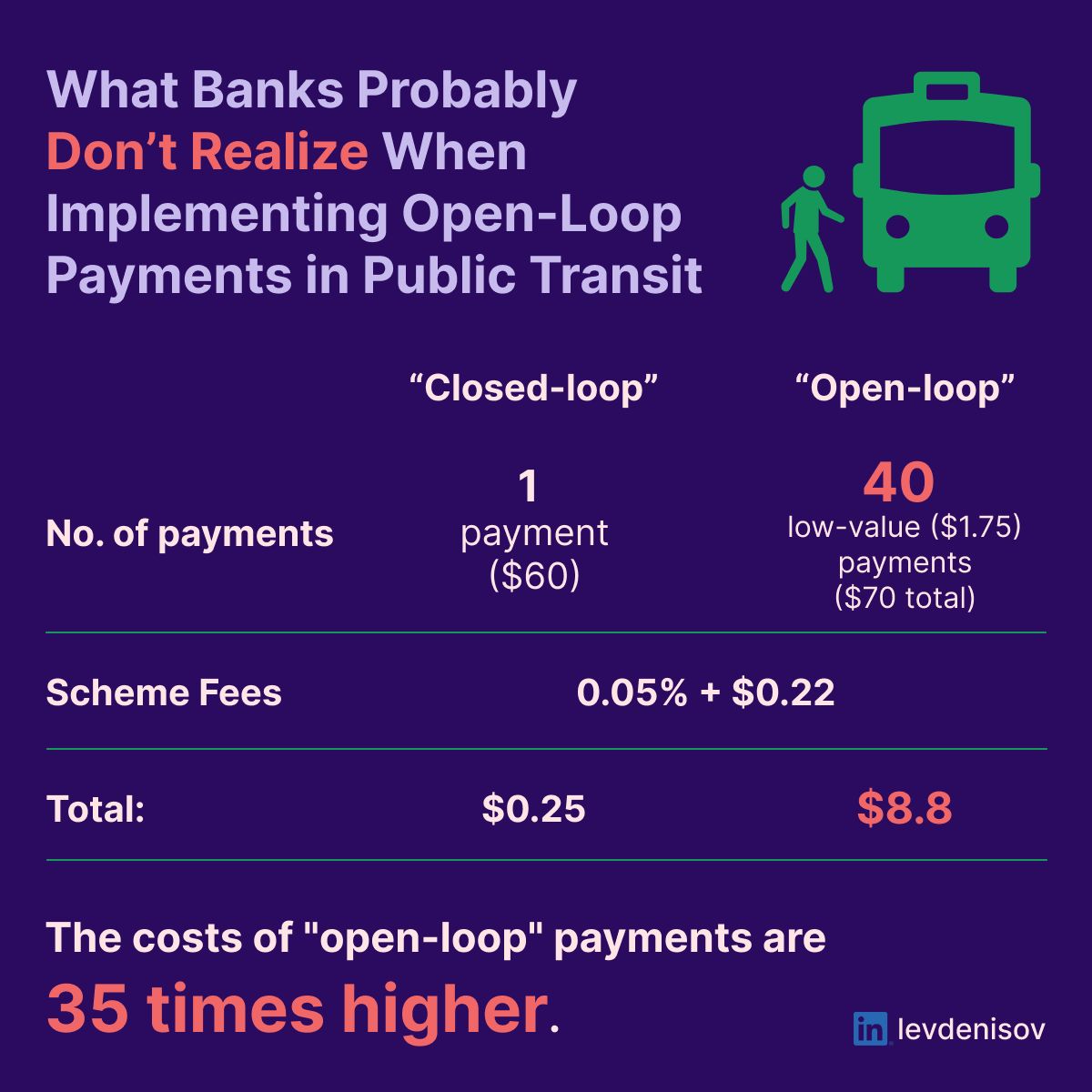

I began with the average cost of a monthly pass (\$60), coupled with the standard price of a single-ride ticket (\$1.75) and the average number of monthly rides per passenger (40).

Next, I calculated the schema fees for a closed-loop system (a monthly electronic ticket purchased via a bank card) versus those of an open-loop system (40 low-value single rides, each paid with a ‘fast, contactless, secure, EMV’ bank card).

In the spirit of optimism, I applied scheme fees that large banks might enjoy (though in reality, this might not always be the case: smaller acquiring banks get higher fees).

The startling conclusion? Open-loop payments are 35 times more costly! See the infographic below.

(I wonder, who pays this extra price? The answer is obvious, though…)

It’s no secret that card networks, and by extension, banks, have a distaste for low-value, high-risk transactions. Why then, does this apprehension not extend to the implementation of open-loop payments in public transit? Did they neglect the crucial step of calculation?

Perhaps I hold an answer, or at the very least, a plausible explanation, which I intend to cover in my upcoming posts… if there will be any after this one. Let’s see if the “powers that be” let the conversation continue… 😉